Foreword

Taxation is a matter which can arouse strong passions, deep disagreements, and much confusion. That is, in part, due to two things.

The first is that while many people do not like paying tax, few want to do away with the services tax pays for: supporting the retired, health, education, infrastructure (including public transport), the protection of the environment, public order and much more.

The second, which helps explain the breadth and complexity of this interim report, is that arguably no forms of tax are all bad, neither are they all good. Taxes live in the world of greys, not that of black and white (much as some politicians as well as some economists might assert otherwise).

That reality underlies the fact this interim report does not arrive at firm or definitive conclusions on many issues. On some of the more controversial matters - such as the extension of the taxation of capital income - we have attempted to provide and explain various options.

On others, such as environmental taxes, we have been specific in some cases, more general in others. We also point the way towards longer term possibilities for systemic tax reform that may assist the transformation of our economy, consistent with and contributing to the Government's goal of zero net carbon emissions by 2050.

On a few matters, for example alteration to the structure of GST, we have been very clear in not supporting any such changes but point to the need for other policy levers to be used to address underlying problems.

The Tax Working Group recognises that there is a great deal more work to be done before we present our final report in February next year. This work will include, in particular, further consideration of the details of possible extensions to the taxation of capital income and the distributional consequences of various options for tax changes.

My hope is that people will consider their responses carefully to this interim report. The Group has a wide variety of people on it, yet we have produced a report which we can all recommend for that careful consideration. Feedback is welcome and can be sent to:

submissions@taxworkinggroup.govt.nz

Given the tight deadlines for the final report, feedback is appreciated as soon as possible.

Michael Cullen, KNZM

Chair, Tax Working Group

September 2018

Executive Summary

Nei rā ka tau mai rā te ao hurihuri nei; he hau mai tawhiti, he tohu raukura nā ngā tīpuna. Inā Te Tiriti o Waitangi tonu! He tauira, kōkiritia te kaupapa nei! Rau rangatira mā.

Nāu! Nāku! Kia ora ai tātou.

Tēnā koutou. Tēnā tātou!

Kia ora tātou katoa!

As the changing world swirls about us, we muster wisdoms from our pasts to help, helping us to forge ahead in a new world. Bearing the raukura plume of our forebears, and the dignity of Te Tiriti o Waitangi, we can address, grapple with, and overcome this challenge!

Greetings all! We invite you to contribute and to participate - knowing that from everyone's efforts, new paths are found. Our greetings, and our acknowledgments to all.

Kia ora tatou katoa!

A national conversation on the future of tax

Over the past nine months, the Tax Working Group has engaged in a national conversation with New Zealanders about the future of the tax system. Thousands of New Zealanders - including iwi, businesses, unions, and other organisations - have had their say. It is clear to the Group that tax matters to everyone.

There is good reason for this passion. The tax system underpins the living standards of New Zealanders in three important respects: as a source of revenue for public services; as a means of redistribution; and as a policy instrument in its own right. The Group has been alert to these multiple purposes in the course of its work.

The Group also believes it is important to bring a broad conception of wellbeing and living standards to its work - including a consideration of Te Ao Māori perspectives on the tax system. This approach reflects the composition of the Group, which includes members with a diverse range of skills and experience, including from beyond the tax system.

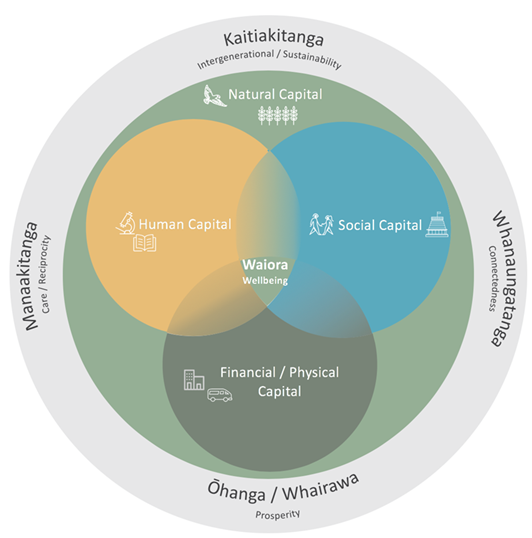

The Group is currently working with stakeholders to develop a framework to support the future evolution of the tax system that reflects principles from Te Ao Māori, alongside the four capitals of the Living Standards Framework and the principles of tax policy design. This includes exploring concepts of waiora (wellbeing), manaakitanga (care and respect), kaitiakitanga (stewardship), whanaungatanga (relationships and connectedness), and ōhanga (prosperity).

Challenges, risks, and opportunities

The Group's Submissions Background Paper invited submitters to share their views on the challenges, risks, and opportunities facing the tax system. The Group has received thousands of submissions since the release of the Submissions Background Paper, and would like to thank all submitters for taking the time to share their views and perspectives on the future of tax.

Reading through the submissions, there appear to be five areas of common concern to New Zealanders:

- climate change and environmental degradation

- changes in business, technology, and the nature of work

- demographic change, in particular the aging of the population

- wealth inequality, and the progressivity, fairness, and integrity of the tax system

- the treatment of capital, savings (especially retirement savings), and housing in the tax system.

Submitters sometimes differed in their views about how these issues would affect the tax system, and how the tax system should respond to them. Nevertheless, there does appear to be a largely shared view about the challenges, risks, and opportunities ahead of us.

The structure, fairness, and balance of the tax system

One of the key tasks for the Group has been to assess the structure, fairness, and balance of the tax system. Although the tax system has many strengths, the Group has found that the tax system relies on a relatively narrow range of taxes, and is not particularly progressive. There are a number of reasons for these outcomes, but two issues stand out for the Group:

- The inconsistent taxation of capital income. A significant element of capital income - gains from the sale of capital assets - is not taxed on a consistent basis. This treatment reduces the fairness of the tax system. It also regressive, because it benefits the wealthiest members of our society. Both effects risk undermining the social capital that sustains public acceptance of the tax system.

- The treatment of natural capital. New Zealand makes relatively little use of environmental taxation. There are clear opportunities to increase environmental taxation, both to broaden the revenue base, and to help address the significant environmental challenges we face as a nation.

Interim conclusions

The taxation of capital income

In light of its findings on the structure, fairness, and balance of the tax system, the Group has devoted much time to the taxation of capital income. At present, the Group is examining the merits of extending the taxation of capital income.

Extending the taxation of capital income will have a range of advantages and disadvantages. It will improve the fairness and integrity of the tax system, and level the playing field between different types of investments. It will provide an increasing source of revenue over time; depending on design, it will also enhance the sustainability of the tax system (particularly if the difference between the company rate and the top personal rate increases in the future).

Yet extending the taxation of capital income will also increase administration and compliance costs, and could lead to some reduction in the overall level of saving and investment in the economy.

It is difficult to form a judgement about the strength of these impacts in the abstract. This is because the nature of the impacts will be heavily dependent on the details of policy design. It is also important to ensure that policy design is as simple and effective as possible, reaping all potential benefits while minimising potential disadvantages. The Group has thus decided to work through, in substantial detail, the policy choices involved in the design of an extended taxation of capital income.

The Group is currently considering two main options: an extension of the existing tax net (through the taxation of gains on assets that are not already taxed); and the taxation of deemed returns from certain assets (known as the risk-free rate of return method of taxation). The Group is not recommending a wealth tax or a land tax.

The Group has made good progress in determining what income might be included from certain assets, and when this income might be taxed - but there is still much work to do.

Retirement savings

New Zealand currently offers few incentives for retirement saving. KiwiSaver is targeted at providing greater proportionate benefits to those on lower incomes, but those on the bottom two marginal tax rate do not benefit from the fact that the top PIE rate is 28%.

The Group has identified opportunities to encourage saving among low- and middle-income earners, and make the tax treatment of retirement savings fairer. However, the treatment of retirement savings is interlinked with the treatment of capital income. The Group will need to give further consideration to the choices and trade-offs around retirement savings in the Final Report.

Housing affordability

It is also evident that New Zealanders are deeply concerned about the high cost of housing, and its impact on wealth inequality, social cohesion, and social capital. Consistent with these concerns, the Group has been directed to have special regard to housing affordability in its work.

The cause of unaffordable housing is, in one sense, straightforward. New Zealand has been unable to build enough houses to satisfy demand at current rates of population growth. This shortfall reflects a number of interlinked problems in the supply of housing - including land use constraints, infrastructure constraints, and high building costs.

The tax system is not responsible for constraints in the supply of housing, but it does influence demand for housing. Certain features of the tax system - such as the inconsistent treatment of capital income - have probably exacerbated the house price cycle in New Zealand, even if the tax system is not the primary cause of unaffordable housing.

The Group's work on housing affordability is closely linked to its work on the taxation of capital income. There is an open question as to whether an extension of capital income taxation would have a material effect on the housing market. A concern for the Group is to understand these impacts further.

Environmental and ecological outcomes

Another key task for the Group is to examine how the tax system can sustain and enhance New Zealand's natural capital for positive environmental and ecological outcomes.

The environmental challenges we face require profound change to the pattern of economic activity. It is necessary for policy-makers to think in terms of systems change - and to develop a set of goals and principles that can guide a transition, over many decades, to a more sustainable economy. Taxation is one tool - alongside regulation and spending measures - that can be used to support and guide this transition.

As an initial step, the Group has developed a framework for deciding when to apply taxes to address negative environmental externalities.

Box: Draft framework for taxing negative environmental externalities

The suitability of taxation as a policy instrument (relative to other potential instruments) can be assessed through the following principles: measurability; behavioural responsiveness; risk tolerance; and scale.

Taxation may be more useful as a policy response when there is a diversity of responses available to respond to the tax, and when there is significant revenue-raising potential.

There are also five design principles that warrant particular attention: Māori rights and interests and distributional impacts must be addressed; the price of the tax should reflect the full cost of externalities; the price should vary locally where there is local variation in impacts; and international linkages should be considered.

The Group believes there is significant scope for the tax system to play a greater role in sustaining and enhancing New Zealand's natural capital.

- In the short term, there may be benefits from expanding the coverage and rate of the Waste Disposal Levy, as well as strengthening the Emissions Trading Scheme, and advancing the use of congestion charging.

- In the medium term, there could be benefits from the greater use of tax instruments to address water pollution and water abstraction challenges. Addressing Māori rights and interests in fresh water should be central to any changes.

- In the long term, environmental taxes could help to address other challenges, such as biodiversity loss, and impacts on ecosystem services.

Corrective taxes

A tax on an environmental externality is a type of corrective tax - a tax that is primarily intended to change behaviour. Outside of the environmental sphere, New Zealand currently levies corrective taxes on the consumption of alcohol and tobacco. The Group also received many submissions calling for taxes on the consumption of sugar.

The Group is reluctant to provide recommendations on the rates of alcohol and tobacco excise, since these require the input of public health expertise that the Group does not possess. Yet the Group does see a need to simplify the schedule of alcohol excise rates, and is concerned about the distributional impact of further increases in tobacco excise.

The case for the introduction of a sugar tax must rest on a clear view of the Government's objectives. If the Government wishes to reduce the consumption of sugar across the board, a sugar tax is likely to be an effective response. If the Government wishes to reduce the sugar content of particular products, regulation is likely to be more effective. In either case, there is a need to consider taxation alongside other potential policy responses.

Goods and Services Tax (GST)

GST is an important source of revenue for the Government. Yet the Group has received many submissions calling for a reduction in the GST rate - or for the introduction of new GST exceptions (for example, for food and drink) - to reduce the impact of GST on lower-income households.

The Group acknowledges public concerns about the regressive nature of GST. Nevertheless, the Group has decided not to recommend a reduction in the GST rate, or the introduction of new exceptions.

In doing so, the Group does not wish to deny public concerns, but rather to point out that there are more effective ways to increase progressivity than changes to GST.

- The best mechanism to improve incomes for very low income households, for example, will be to increase welfare transfers.

- If the intention is to improve incomes for certain groups of low-to-middle-income earners (such as full-time workers on the minimum wage), then changes to the personal income rates and/or thresholds will be more effective.

One other problematic aspect of GST is the treatment of financial services. Financial services are not subject to GST for reasons of administrative complexity. The Group has considered a number of options for taxing the consumption of financial services, but has not been able to identify a means of doing so that is both feasible and efficient.

The Group does not recommend the introduction of a financial transactions tax at this point.

Personal income and the future of work

Personal income tax is the largest source of revenue for the Government. Alongside GST, it is the primary way in which most New Zealanders interact with the tax system. The fairness and integrity of income tax therefore bears directly on New Zealanders' views of the fairness and integrity of the tax system as a whole.

The Group has not yet finalised its views on the rates and thresholds for income tax, but notes that reductions to the lower rates and/or increases in the lower thresholds would be the most progressive means of assisting low- and middle-income earners through the tax system. The impact of inflation on income tax is best dealt with through periodic reviews of the thresholds.

Most income tax is collected through the PAYE system. PAYE is a withholding system in which employers are responsible for deducting and paying income tax on their employees' behalf. PAYE has served New Zealand extremely well, but its effectiveness will reduce if labour market changes increase the proportion of self-employed workers in the future.

The Group supports Inland Revenue's efforts to increase the compliance of the self-employed, and recommends further expansion of the use of withholding tax (including to digital platform providers, such as ride-sharing companies).

The Group has also discussed support for childcare costs to increase participation in the workforce, but believes this support is best delivered outside the tax system.

The taxation of business

Company tax is an important part of the revenue base. But the taxation of business also has a broader impact on wellbeing. It affects the accumulation of physical and financial capital across the economy; it affects social and human capital by changing the incentives for businesses to create employment and invest in the skills of their workers.

The Group believes that the current approach to the taxation of business is largely sound. The Group does not see a case to reduce the company rate, or to move away from the imputation system. The tax rate for Māori authorities also remains appropriate (although the rate should be extended to the subsidiaries of Māori authorities).

The Government asked the Group to consider the merits of a progressive company tax (with lower rates for small businesses). The Group recommends against the introduction of a progressive company tax on the basis that reductions in compliance costs are likely to be a more effective means of supporting small businesses. The Group is still forming its views on the best ways to reduce compliance costs and enhance business productivity.

The main focus of many submissions, however, was on the treatment of multinationals and digital firms. In this regard, the Group notes that New Zealand is currently participating in discussions at the OECD on the future of the international tax framework. The Group supports this process, but recommends that the Government stand ready to implement an equalisation tax on digital services if a critical mass of other countries move in that direction.

The integrity of the tax system

Most New Zealanders recognise the importance of paying tax, and meet their tax obligations. Some, however, do not. Tax avoidance reduces the integrity of the tax system and erodes social capital. It is also fundamentally unfair, because it means that compliant taxpayers must pay more in order to make up for the lost revenue.

A number of integrity risks have been addressed over the years. For example, the alignment of the trustee rate and the top personal income rate has greatly reduced the use of trusts to shelter income and avoid tax.

At the moment, however, there does appear to be an issue with the use of closely-held companies. Some of the underlying problems here derive from the fact that the company and top personal tax rates are not aligned, but there is a clear need for Inland Revenue to strengthen enforcement around the use of current accounts in closely-held companies.

The Group also recommends measures to reduce the extent of the hidden economy (i.e. undeclared and cash-in-hand transactions). These measures could include an increase in the reporting of labour income, and even the removal of tax deductibility if a taxpayer has not followed labour income withholding or reporting rules.

Tax collection could be enhanced by increasing the penalties for non-compliance. The Group recommends options such as making directors personally liable for arrears on GST and PAYE obligations, and departure prohibition orders in cases of serious wrong-doing. The Group also recommends the establishment of a single Crown debt collection agency, to achieve economies of scale and more equitable outcomes across all Crown debtors.

The Group also recommends that Inland Revenue continue to invest in the technical and investigatory skills of its staff.

The treatment of charities

Charities and not-for-profits make important contributions to the wellbeing of New Zealand. The activities of these organisations enhance the social, human, and natural capital in New Zealand. In turn, the Government supports the work of charities by offering tax exemptions for charity income, and tax benefits for donations to charities.

The Group has received many submissions regarding the treatment of business income for charities, and whether the tax exemption for charitable business income confers an unfair advantage on the trading operations of charities.

The Group's view is that the underlying issue is more about the extent to which charities are distributing or applying the surpluses from their activities (either active businesses or passive investments) for the benefit of the charitable purpose. If a charitable business regularly distributes its funds to its head charity, or provides services connected with its charitable purposes, it will not accumulate capital faster than a taxpaying business. The question, then, is whether the broader policy settings for charities are encouraging appropriate levels of distribution.

The Group is concerned about the treatment of private charitable foundations and trusts. These foundations and trusts benefit from the donor tax concessions, but are not required to have arm's-length governance boards or distribution policies. The rules around these foundations and trusts appear to be unusually loose.

The Group believes that the charity deregistration tax rules could be amended to more effectively keep assets in the sector, and also questions whether the current GST concessions for non-profit bodies are appropriate.

The Government has launched a review of the Charities Act 2005 to ensure it remains effective and fit-for-purpose. Some of the issues identified by the Group could potentially be addressed through this legislative review, or followed up through the Tax Policy Work Programme.

The administration of the tax system

Tax policy is given effect, day in and day out, through the administration of the tax system. The quality of administration is central to public perceptions of the legitimacy and fairness of tax policy; the effectiveness of administration will determine the Government's ability to achieve its policy intent in levying taxation.

Tax secrecy is a topical issue in tax administration at the moment.The Group believes there is a need for greater public access to data and information about the tax system (so long as it does not reveal data about specific individuals or corporates that is not otherwise publically available). Inland Revenue should review whether the information and data it currently collects offers the most useful insights, or whether other data sets would better respond to the needs and interests of the public.

The Group also believes there is a need to improve the resolution of tax disputes. The Group recommends the establishment of a taxpayer advocate service to assist taxpayers in disputes with Inland Revenue, and also wishes to ensure the Office of the Ombudsman is adequately resourced to carry out its functions in relation to tax.

The Group has discussed opportunities to improve the development of tax policy and legislation. In particular, the Group encourages Inland Revenue to engage in good faith consultation with a more diverse range of voices in the development of new policy.

Next steps

The Group has discussed many issues over the past six months - but also recognises that there is still much to do before the presentation of the Final Report in February 2019. This work will include further consideration of measures to extend the taxation of capital income, as well as analysis of the distributional impact of the various options for reform.

The Group believes there are real opportunities to improve the fairness, balance, and structure of the tax system. Yet the Group's views are by no means final, and feedback from all New Zealanders is very much welcome. Together, we can shape the future of tax.

PART I - PURPOSES AND FRAMEWORKS

1 The purposes of tax

1. Over the past nine months, the Group has engaged in a national conversation with New Zealanders about the future of the tax system. Thousands of New Zealanders - including iwi, businesses, unions, and other organisations - have shared their thoughts and had their say on the future of tax.

2. The views and suggestions have differed from submission to submission. Yet the Group has been struck by the depth of interest and passion expressed by all submitters on the issues before us. It is clear that tax matters to everyone.

3. There is good reason for the passion we have seen. If the ultimate purpose of public policy is to improve wellbeing, then few areas of public policy contribute as much to the wellbeing of New Zealanders as the tax system.

4. There are three main ways in which the tax system supports the wellbeing of New Zealanders:

- A fair and efficient source of revenue. Taxes provide revenue for the Government to fund the public goods and services that underpin our living standards. The tax system thus represents a way in which citizens come together to channel resources for the collective good of society.

- A means of redistribution. Taxes fund the redistribution that allows all New Zealanders, regardless of their market income, to participate fully in society. While much of this redistribution occurs through the transfer system, the progressive nature of the income tax means that the tax system also plays a role in reducing inequality.

- A policy instrument to influence behaviours. Taxes can also be used as an instrument to achieve specific policy goals by influencing behaviour. Taxes influence behaviour by changing the price of goods, services, or activities; taxes can discourage certain activities, and favour others. In this way, taxes can complement – or even replace – traditional policy tools such as regulation and spending, depending on which approach reflects the most effective way to achieve society’s goals. This may be particularly important in the environmental sphere.

5. In light of these perspectives, the Group has decided to take a rounded view on the purpose of the tax system. The tax system is essential as a source of revenue to the Government - but it is also an important tool that can be used positively to pursue distributional goals, shape behaviour, improve living standards, and develop sustainably. The Group has been alert to these multiple purposes in developing its recommendations.

2 Frameworks for assessing tax policy

1. The Group believes it is important to bring a broad conception of wellbeing and living standards to its work on the tax system. This approach reflects the composition of the Group, which includes members with a diverse range of skills and experience, including perspectives from beyond the tax system.

2. Many factors affect living standards, and many of these factors have value beyond their contribution to material comfort. Only a subset of those values can be captured in monetary terms, but non-monetary factors are key determinants of wellbeing and living standards. As an example, certain types of economic activity may increase material comfort, but reduce wellbeing overall, if the by-products of that activity degrade the natural environment.

3. To measure wellbeing comprehensively, income measures must therefore be supplemented with measures of other factors, such as health, connectedness, security, rights and capabilities, and sustainability. In the Submissions Background Paper, the Group referred to two perspectives for assessing the full range of impacts from tax policy: the Living Standards Framework, and the established principles of tax policy design.

The Living Standards Framework

4. The Living Standards Framework identifies four capital stocks that are crucial to wellbeing: financial and physical capital; human capital; social capital; and natural capital. Wellbeing depends on the sustainable development and distribution of the four capitals, which together represent the comprehensive wealth of New Zealand.

5. The Living Standards Framework encourages policymakers to explore how policy change affects the four capitals. It widens the scope of analysis to include a more comprehensive range of factors, distributional perspectives, and dynamic considerations. In this way, the Living Standards Framework is consistent in intent with international wellbeing frameworks such as the Sustainable Development Goals (Treasury 2018).

Te Ao Māori perspectives on wellbeing and living standards

6. The Government has identified a need to explore how Te Ao Māori perspectives can inform our understanding and application of the Living Standards Framework. Consistent with this work, the Submissions Background Paper invited submitters to reflect on how tikanga Māori could help to create a more future-focussed tax system.

7. The Group is currently working with stakeholders to develop a framework that draws on principles from Te Ao Māori, and encompasses the four capitals of the Living Standards Framework, as well as the principles of tax policy design, to arrive at a more holistic view of wellbeing.

8. The framework is centred on the concept of waiora. Waiora is commonly used in Te Ao Māori to express wellbeing; it comes from the word for water (wai) as the source of all life.

9. The framework then draws upon four tikanga principles: manaakitanga (care and respect); kaitiakitanga (stewardship); whanaungatanga (the relationships/connections between us); and ōhanga (prosperity). These principles support the preservation and sustainable development of the four capitals of the Living Standards Framework.

Figure 2.1: Bringing together Te Ao Māori perspectives and the Living Standards Framework

10. The Group will conduct further engagement on the development and application of this framework in October, to ensure that the framework is meaningful, inclusive, and enhances tax policy development for Māori and all New Zealanders. This process will also inform the ongoing development of the Living Standards Framework.

11. While this framework is still under development, the Group has noted areas in subsequent analysis where tikanga concepts seem to have particular resonance - but this is very much a work in progress that will need to be fleshed out further in the Final Report, following further engagement with stakeholders.

The established principles of tax policy design

12. Previous tax reviews, in New Zealand and elsewhere, have used a relatively consistent set of principles to assess the design of the tax system. These principles are efficiency, equity and fairness, revenue integrity, fiscal adequacy, compliance and administration costs, and coherence.

13. Two further important principles in the tax system are predictability and certainty – meaning that taxpayers should be able to understand clearly what their obligations are before those obligations are due.

14. The Group believes these principles remain valid and useful in assessments of the tax system, particularly when considering the costs and benefits of options for reform. These principles complement the systems perspective offered by a broader living standards analysis.

Submitter perspectives on assessment frameworks

15. Many public submitters commented on the Group's choice of assessment framework. Most submitters supported the Group's decision to apply both the established principles of tax policy design and a broader Living Standards lens.

16. These submitters felt that the established principles provided a proven method of evaluating tax policy, while the Living Standards Framework ensured that the analysis would incorporate a fuller range of perspectives.

17. Māori submitters also encouraged the Group to bring a Te Ao Māori perspective to the design of the tax system.

18. A broader message the Group has taken from submitters is that it is necessary to bring a wide range of perspectives to bear on its analysis. This will ensure stakeholders have a clear understanding of the wellbeing and living standards impacts of the options before us.

PART II - ISSUES AND CHALLENGES

3 New Zealand's current tax system

1. The Group's Submissions Background Paper explored the features of the current tax system in some depth. This chapter will revisit the key features of the tax system, with a focus on those features that are particularly distinctive about New Zealand.

The 'broad-base, low rate' tax policy framework

2. New Zealand’s current tax system is underpinned by a tax policy framework known as 'broad-base, low rate.’ In a broad-based system, there should be few exceptions to the base on which the tax is levied. The benefit of a broad-based system is that it allows the Government to raise substantial amounts of revenue at relatively low rates of taxation.

3. The 'broad-base, low rate' framework is reflected in the tax system's reliance on three main taxes: the personal income tax, the company income tax, and the Goods and Services Tax (GST). The Government raises about 90% of its tax revenue from these three taxes. This is a relatively narrow range of taxation, and means that New Zealand relies little on other potential sources of revenue, such as environmental taxation.

Figure 3.1: Source of taxation revenue, 2015 (OECD countries)

Source: OECD

4. The taxes that New Zealand does levy have relatively broad bases. This allows the Government to raise significant amounts of revenue at rates lower than in most OECD countries. Compared with other OECD countries:

- New Zealand raises roughly equivalent amounts of revenue. Total tax revenue, including local government rates, stands at 32% of GDP. This is only slightly below the OECD average of 34% of GDP.

- New Zealand has a low GST rate, and one of the lowest top personal tax rates, but collects high proportions of income tax revenue and GST revenue to GDP.

- New Zealand's company rate is above average, and company tax revenue to GDP is high. After imputation, however, New Zealand's tax rate on domestic shareholders is the sixth-lowest in the OECD. New Zealand is more reliant on company tax revenue than most other OECD countries.

- New Zealand raises little revenue from environmental taxation[1].

Distinctive features

5. New Zealand's tax system is quite distinctive in some respects. New Zealand makes little use of social security levies, environmental taxes, or corrective taxes (with the notable exceptions of alcohol and tobacco excise taxes, which are intended to discourage drinking and smoking). On the other hand, New Zealand's GST regime has few exceptions compared to other countries, and is therefore very efficient at raising revenue.

6. New Zealand's treatment of capital income also diverges from the approach taken by other countries. This is because New Zealand does not generally tax capital income in the form of gains. Thus, gains from the sale of shares and businesses, and some sales of land[2], are not generally taxed - whereas gains from financial arrangements and some sales of land are taxed.

7. New Zealand offers few concessions for retirement saving: retirement saving contributions are taxed when they are made and as investment income is earned, rather than when the savings are drawn down in retirement.

8. The other distinctive feature of New Zealand’s tax system is the imputation regime, which prevents the double taxation of company income that is distributed as dividends. The imputation regime is discussed further in Chapter 14 on The taxation of business.

9. Outside the national tax system, rates are the primary source of revenue for local government. Rates are a narrow-based wealth tax on real estate. Local authorities in New Zealand, unlike their counterparts in most other jurisdictions, do not have the power to levy sales taxes, income taxes, or transaction taxes.

Distributional outcomes

10. There are different ways of measuring the distributional outcomes of the tax system. In absolute terms, higher-income households play an important role in funding the Government. The share of income tax paid increases as household income increases. Households in the top income decile pay around 35% of all income tax (on 30% of total household gross income), whereas households in the lowest five income deciles collectively pay less than 20% of all income tax (on 23% of total household gross income).

11. In other respects, however, the tax system is not particularly progressive. As Figure 3.3 illustrates, for example, there is not a significant increase in average effective tax rates across income deciles, even though the amount of tax paid increases by income decile.

12. Instead, progressivity is largely delivered through transfers, such as Working for Families. Figure 3.3 shows that households in the lowest four deciles do not, on average, pay any net tax after transfers are subtracted from income tax, GST, and ACC levies. There are higher net taxes as income increases.

Figure 3.2: Percentage of income tax and transfers by income decile, 2014/15

Source: Bryan Perry, Ministry of Social Development, 2017 (data based on Household Economic Survey (HES) 2015).

Figure 3.3: Average effective tax rate (income tax, GST, and ACC levies less transfers), by income decile, 2012/13

Source: The Treasury (data based on HES 2013).

13. The inequality-reducing power of the tax and transfer system has fallen over the last three decades (Perry 2017). This outcome reflects the fact that the tax system and the transfer system have both become less effective at reducing inequality.

14. It is difficult to make cross-country comparisons on this issue, because the outcome may be affected by choices about which taxes are included and which are excluded for the purposes of the analysis. Figure 3.4 is based on the OECD Income Distribution database; it includes personal income taxes, employees' social security contributions, and cash transfers, but excludes payroll taxes and value-added taxes (including GST). Figure 3.4 illustrates that New Zealand's tax and transfer system reduces income inequality, but by less than is the case in Australia, or on average across the OECD.

15. The progressivity of the tax system is also affected by the treatment of capital income. The incomplete taxation of capital income benefits the wealthy, whereas the absence of large concessions for retirement saving is a more progressive feature of the system.

Gender outcomes

16. As women's personal income levels are less than men's, they will pay less tax than men overall. Women also receive more in transfers than men. They therefore benefit less from tax reductions or tax concessions, and are more adversely affected by reductions in social welfare benefits. The average annual income of women is around $36,000, and the average income of men is around $54,000. The median annual income of women is around $26,000, and the median annual income of men is around $45,000.[3] Figure 3.5 shows the distribution of men and women by income decile.

17. The incomplete taxation of capital income is also likely to benefit men more than women, who have greater levels of personal wealth.

Figure 3.4: Reduction in Gini coefficient on account of the tax and transfer system, 2014/15

Source: OECD

Figure 3.5 Distribution of males and females by annual personal income decile (people aged 15 years and over), 2015/16

Source: Statistics New Zealand.

Summary

18. Two key points emerge from this discussion of the current tax system:

- New Zealand relies on a relatively narrow range of taxes. The Government raises about 90% of its tax revenue from only three taxes: the personal income tax; the company income tax; and GST. New Zealand makes little use of other sources of taxation, such as social security levies, environmental taxes, or corrective taxes. Thus, while the taxes that are levied have broad bases, the overall range of taxation is relatively narrow.

- The tax system is not particularly progressive. Instead, progressivity is largely delivered through transfers, such as Working for Families. Yet New Zealand’s tax and transfer system reduces income inequality by less than the OECD average. The progressivity of the tax system is also affected by the treatment of capital income. The inconsistent taxation of capital income from gains primarily benefits the wealthy.

19. In subsequent chapters, the Group will explore the issues and opportunities that arise from these key features of the tax system.

Notes

4 Issues and challenges raised by submitters

1. Tax systems have always evolved alongside changing practices in business, technology, and society. Today, however, change is particularly relentless, and technology is having a radical impact on the way businesses operate - both within and across national borders.

2. In the Submissions Background Paper, the Group identified eight challenges, risks, and opportunities that the tax system will face over the coming decade and beyond:

- Changing demographics, particularly the aging population and the fiscal pressures that will bring.

- Te Ao Māori and the role of the Māori economy in lifting New Zealand's overall living standards.

- The changing nature of work.

- Technological change and the different business models that will bring.

- Falling company tax rates around the world.

- Environmental challenges, including climate change and loss of ecosystem services and species.

- Growing concern about inequality.

- The impacts of globalisation and changes in its patterns.

3. The Group asked submitters to share their views on how these challenges and opportunities might affect the tax system. The Group also asked submitters to tell us whether we had missed any important issues.

Submitter perspectives

4. Submitters generally agreed with the issues that we identified. Reading through the submissions, there appear to five broad areas of common concern to New Zealanders.

Climate change and environmental degradation

5. The Group received a large number of submissions about the twin challenges of climate change and environmental degradation. New Zealanders are concerned about the state of the environment, and their concerns cover effects at the local, national, and global levels.

6. Yet there was also much debate about the role of the tax system in responding to these challenges. Many submitters are clearly looking to the Group to recommend the introduction of specific environmental taxes. Others question whether tax is the right instrument to address environmental problems.

7. In either case, most submitters stressed that tax should not be considered in isolation when dealing with the environment; instead, the merits of tax as a policy instrument should be assessed together with the merits of other tools and approaches.

Changes in business, technology, and the nature of work

8. Many submitters agreed with the Group that the tax system must respond to changes in business, technology, and the nature of work. Submitters highlighted four pressure points for our attention:

- The erosion of the PAYE base as working arrangements change.

- The growing importance of capital income relative to labour income.

- The tax treatment of the digital economy.

- International business activity.

9. Some submitters also signalled the importance of maintaining the international competitiveness of the New Zealand tax system, particularly in a context where corporate tax rates are falling in other countries. The Group has heard clearly from submitters that the tax system should support the productivity of the New Zealand economy.

10. Some submitters also suggested there is further scope to improve the administration of the tax system through investments in new technology.

Demographic change

11. Submitters acknowledged the impact of the ageing population, which will result in slower revenue growth and higher Government expenses on the health system and on New Zealand Superannuation.

12. For the Group, this point reinforces the importance of maintaining a sustainable revenue base over time. A sustainable revenue base must be flexible enough to respond to increasing demands for public services, yet provide reasonable certainty to taxpayers by signposting the direction of tax policy and avoiding unexpected policy shocks.

13. Some submitters also highlighted the increasing diversity of the New Zealand population. There will be an increasing proportion of Māori, Pasifika, Asian, and other ethnicities in the working age population over the coming decades. Submitters pointed to the need to reduce disparities between population groups and enhance the potential of all rangatahi (young people).

Progressivity, fairness, and integrity

14. Many submitters are worried that rising inequality will reduce wellbeing and social cohesion in New Zealand. Consequently, most submitters - but not all - expressed support for a more progressive tax system.

15. These concerns about the impact of inequality were often bound up with concerns about the fairness and integrity of the tax system. Many submitters argued that the inconsistent taxation of capital gains and the treatment of international business activity reduce the fairness and integrity of the tax system.

16. There were a number of submissions regarding the hidden economy and the effectiveness of tax collection. Submitters made the point that public buy-in to the tax system rests on the belief that all New Zealanders are paying their fair share of taxes. The Group agrees, and has prioritised the issue of the integrity of the tax system during the course of its work.

17. The Group also received submissions on the interface between the tax and transfer systems. The Terms of Reference exclude the Group from making specific recommendations on this subject, but the Group has been mindful of the tax/transfer interface in the course of its work, and is maintaining a dialogue with the Welfare Expert Advisory Group.[4]

Capital, savings, and housing

18. The issues of capital, savings, and housing recur throughout the submissions. It is clear to the Group that these issues lie at the heart of public concerns about the tax system. Indeed, the treatment of capital, saving, and housing is inextricably linked to judgements about the structure, fairness, and balance of the tax system as a whole.

19. The submissions ranged widely. Many submitters are concerned about the extent to which the tax system affects saving and investment decisions. There were particularly strong views about the impact of the tax system on the housing market. Submitters also made vigorous arguments for and against tax reductions, especially on retirement savings.

20. Having read through these submissions, the Group has devoted considerable time to the taxation of capital, savings, and housing. Our task is to chart a way forward on these issues that is fair, durable, and efficient.

Notes

- [4]The Government established the Welfare Expert Advisory Group in May 2018 to conduct a broad-ranging review of the welfare system. Among other things, the Welfare Expert Advisory Group has been tasked to develop recommendations for improving Working for Families, and to examine other areas where the interface with the welfare system is not functioning well.

5 The structure, fairness, and balance of the tax system

1. The Group has been asked to assess the structure, fairness, and balance of the tax system. These are subjective concepts, and there are different ways to work towards a judgement on them. The Group has borne the following questions in mind in the course of its work:

- Does the tax system treat income consistently, no matter how it is earned and in which sectors it is earned?

- Does the tax system minimise opportunities for tax avoidance?

- Are the bases of the tax system likely to be sustainable over time?

- Should taxation be used as a tool to influence behaviour?

2. This chapter will begin to form a judgement on these questions through two lenses: the treatment of financial and physical capital; and the treatment of natural capital stocks.

Concepts of income

3. Underlying these judgements are some key assumptions about what constitutes 'income.' Income may be an easy word to say, but it has many different meanings.

4. There are accounting definitions of income, and economic definitions of income. 'Haig-Simons income,' for example, is defined as 'consumption plus changes in net worth' (JCT 2012). Then there are welfare definitions, which are used to assess whether an individual is eligible for income-tested benefits, and lay definitions, which might be as simple as 'cash in hand.' All of these forms of income can be represented in either nominal or inflation-adjusted terms. Natural capital can also generate 'income' in the form of ecological services.

5. A second set of definitions relates to the taxable unit. In the tax system, this may include individuals, households, and entities such as companies and trusts. Dominant cultural assumptions, for example regarding the definition of the family, underpin the use of these definitions within the tax system.

6. None of these concepts of income are right or wrong. They are all relevant in certain contexts. The challenge for policymakers is to think about what definition of income and taxable unit will be most appropriate in the context of each policy decision.

7. In this regard, the differences in income definitions between the tax and welfare systems appear to be particularly problematic, because they create confusion for individuals trying to understand their entitlements when they move in and out of the welfare system. The Group considers that this issue would be most appropriately considered by the Welfare Expert Advisory Group.

Labour income and capital income

8. A first way of judging the structure, fairness, and balance of the tax system is to assess whether income appears to be treated in a consistent manner, no matter how it is earned.

9. Income in the tax system is divided into two broad categories: labour income and capital income. Labour income is income earned from performing services (such as a wage or salary), or from personal exertion. Capital income is income earned from an asset.

10. Labour income is taxed through the income tax. Much capital income is taxed as well. Interest, rents, royalties, and receipts earned in the ordinary course of business are all subject to income tax. The tax rate depends on the type of entity earning the income.[5] Companies, for example, are taxed at a rate of 28%, whereas individuals are taxed on a progressive scale.[6]

11. However, there is a significant element of capital income which is generally not taxed -receipts which often come from the sale of capital assets. This element of capital income is commonly known as 'capital gains.' While currently generally outside the tax system, realised capital gains provide a basis for consumption in the same way as labour or interest income.

General principles

12. New Zealand's income tax law is founded on a distinction between income (or 'revenue') gains and expenditure, which are taxed and deductible, and capital gains and expenditure, which are exempt and non-deductible.[7]

13. In principle, gains derived in the ordinary course of carrying on a business are income and therefore taxable, and other gains are generally exempt. In practice, it is often difficult to draw this distinction, because it depends on judgements about a person's intentions, the nature of their business, and the role of a particular asset, liability or payment within that business.

14. New Zealand already taxes some payments that used to be treated as capital payments. Examples of taxable capital gains include lease inducement and surrender payments, proceeds from the sales of patents, and gains from certain land sales. The rationale for doing so, in general, is that these payments are particularly substitutable for taxable income.

15. Sometimes tax avoidance law applies to tax a capital gain. For example, some share sales are taxable on the basis that they include income that would otherwise have been received as dividends. In this case, the basis for taxation is a judgement that, in substance, the gain 'should' be taxed - even if the ordinary application of the law would place the gain on capital account.

Gains from specific classes of physical and financial capital

Land

16. Gains on the sale of land are taxable if the land was bought with a purpose or intention of resale, even if resale was not the only or dominant purpose or intention of the purchase. Capital losses are generally not deductible unless a gain on the sale of the property would be taxable.

17. The bright-line test for residential property sales aids the enforcement of this rule. It serves as a proxy for 'purpose of disposal' - which can otherwise be difficult to enforce - by taxing the sale of any residential property within five years of purchase, subject to some exceptions. The most important exception is that the family home is generally excluded from the test.

18. Capital gains on owner-occupied homes are not generally taxed. There are two main exceptions: the 'main home' exclusion from the bright-line test can only be used twice in a two-year period; and owner-occupiers with a regular pattern of buying and selling residential land cannot use the 'main home' exclusion for the land sale rules, including the bright-line rule.

19. Land affected by changes to zoning, consents, or other specified changes may be taxed on sale, if the sale is within ten years of acquisition. If at least 20% of the gain on disposal can be attributed to the change, the whole gain is taxable. However, the taxable amount is reduced by 10% for each year the taxpayer has owned the land.

20. Land disposals may be taxed if an undertaking or scheme involving more than minor development or division of the land was commenced within ten years of the land being acquired. Land disposals may also be taxed if there has been an undertaking or scheme of division or development of the land that involves significant expenditure on specified works, subject to a number of exclusions.

21. Most of the land sale rules represent attempts to codify or buttress common law principles that would have made land sales taxable in any event. Because the principles are factually dependent, however, the rules also tend to be factually dependent, and have given rise to much uncertainty and litigation. They are also difficult to enforce at a practical level.

Shares in New Zealand companies

22. Gains on shares are only taxable if they have been acquired for the dominant purpose of disposal, or in the course of a person's share dealing business. Shares are otherwise held on capital account, and gains on those shares are not taxable.

23. In practice, it can be difficult to determine the dominant purpose of acquisition, or whether a person is a share dealer who acquired the shares in the course of their business. Although most people acquire shares with a view to selling them at some later time for a profit, this fact is insufficient by itself to satisfy the 'dominant purpose' test.

24. Enforcement is difficult. Taxpayers tend to take the view that they have not acquired shares with a purpose of resale; the case law is extensive and contains many decisions that taxpayers can use to justify a revenue-unfavourable outcome. Yet the law also creates uncertainty for taxpayers, and it can be costly for taxpayers to defend if Inland Revenue decides to audit a transaction.

25. Several aspects of the regime for taxing companies and shares in companies are worth exploring in more detail:

- Shares held by portfolio investment entities (PIEs). Gains on Australasian shares held by PIEs are not taxable. This treatment is a response to the fact that gains on shares held by individuals are in practice rarely taxable. Applying a different approach to PIEs would have created a bias against the use of managed funds for equity investment, so managed funds operating as PIEs are exempted from taxation on the sales of New Zealand and Australian shares.

- Non-portfolio professional investors. There is uncertainty regarding the treatment of share sale gains and losses by angel, venture capital, and private equity investors. In practice, gains to these investors are rarely returned as taxable and losses are rarely claimed as deductible.

Shares in foreign companies

26. The fair dividend rate (FDR) method is generally used to tax portfolio investment in foreign shares (other than in Australian listed companies). Shares are generally taxed on a 5% deemed return, based on the opening value of the shares in each year. Actual dividends and sale proceeds are not taxed. However, in any given year, individuals and family trusts can pay tax on the actual return from their foreign share portfolio (including accruing gains and losses) if it is lower than the deemed return.

27. FDR is intended to raise revenue, while reducing the bias against foreign equity investment through managed funds. For domestic shares, this bias was dealt with by exempting PIEs from tax on gains from sale. But this approach would be problematic in relation to foreign shares. Since the income of foreign companies is not taxed unless it is earned in New Zealand, and such companies often do not pay large dividends, a failure to tax the gain on sale would allow most of the return from the investment to escape the domestic tax system. The solution was to tax both individuals and funds on a reasonable - but approximate - deemed return.

28. The following approaches apply for direct investment where the shareholder owns more than 10% of the non-resident company:

- Controlled foreign companies. The capital/revenue distinction applies to controlled foreign companies, with the result that most gains on sale are not taxable and most losses are not deductible. However, income from holdings in passive investments is directly attributed to the shareholders.

- Other types of direct investment. In other cases, the shareholder can generally choose between treating the investment as a portfolio investment (in which case it is taxed under the FDR method) or in a similar fashion to shares in a controlled foreign company (in which case there is attribution if the holding is passive).

Capital losses and expenses

29. The capital/revenue test applied by the courts denies deductions for capital expenses, but deductions are allowed by statute for many types of expenditure that would otherwise sit on capital account. This includes deductions for depreciation. Depreciation deductions initially applied only to tangible property, but have been extended to apply to forms of depreciating intangible property, such as computer software, and even to the costs associated with unsuccessful attempts to acquire certain types of property.

30. No deductions are allowed for the cost of acquiring goodwill (since payments received for goodwill are not taxable). Building depreciation deductions were abolished in 2010.

Assessment

31. There are inconsistencies in the current treatment of capital income. Much capital income is taxed, but income from the sale of capital assets is often not taxed. The most significant forms of capital income outside the tax net are gains from the sale of land (including housing), shares (other than portfolio investment in non-resident companies), businesses, and intellectual property, in cases where those assets have been acquired for a purpose other than sale.

The treatment of sectors and industries

32. A second way of judging the structure, fairness, and balance of the tax system is to assess whether the tax system deals with different sectors and industries in a broadly consistent way. An analysis of effective company tax rates can provide an insight into this issue.

The lens of effective tax rate analysis

33. New Zealand's statutory company tax rate is 28%. However, companies may pay a rate of tax on their accounting profit that is different to the statutory tax rate. This outcome may arise due to differences in how tax rules apply to companies, and differences between taxable income and accounting income.

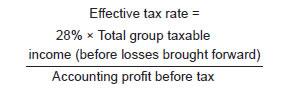

34. The effective tax rate compares the amount of income tax paid by a company with their accounting profit before tax. It can be defined as follows:

35. Effective tax rates can provide a high level indication of where there may be under-taxation of companies, in particular where companies are paying a low level of tax relative to their accounting profits. What this means is the actual tax rate paid by the company can vary from the statutory rate of 28%. For example, if half of a company's profit were untaxed capital gains it might have an effective tax rate of 14% rather than the statutory tax rate of 28%.

36. Yet there are a number of limitations to effective tax rate analysis. Perhaps the most significant is that low effective tax rates can reflect the impact of deliberate policy choices such as the introduction of tax concessions in certain industries.

37. Additional caveats to effective tax rate analysis include:

- Effective tax rates look at the income tax paid by companies, not by their shareholders or other entities. In some instances, under-taxation will be 'corrected' by the dividend or imputation rules.

- The results are sensitive to the choice of time period.

- New Zealand has thin markets, so the results of a small number of firms can significantly skew sector analysis.

- Accounting may not be the most appropriate measure for considering income tax as it is more accrual-based than income tax is.

- There are margins of error associated with data quality and technical issues.

Effective tax rates by sector and industry

38. Inland Revenue and the Treasury have calculated the effective tax rates of significant enterprises in a number of industry groups (Inland Revenue & Treasury 2018). This analysis indicates that some industries appear to pay a low amount of tax relative to their accounting profit.

39. There may be valid reasons for tax treatment to differ from accounting treatment. Some companies may be earning foreign income that is not taxed in New Zealand, and there are areas where tax rules differ from accounting rules (for example, relating to the treatment of depreciation).

40. The most significant cause of low effective tax rates, however, appears to be untaxed income in the form of gains from capital assets. A more consistent approach to the taxation of this form of capital income would bring effective tax rates closer to statutory rates in many industries. Taxing gains on disposal would not, however, have much of an impact on industries that hold assets for the long term. It would also not impact industries where income is already subject to tax, but there are significant timing benefits for deductions.

41. The Group also notes that some industries benefit from deliberate tax concessions. Examples include accelerated deductions for certain types of farming, film, and forestry expenditure, as well as petroleum mining. The Government should keep these concessions under periodic review to ensure they remain consistent with its policy intent.

Natural capital

42. This chapter has thus far assessed the structure, fairness, and balance of the tax system from a traditional tax perspective. A broader Living Standards Framework perspective would consider the relationship between natural capital and the tax system, and acknowledge natural capital as a profound and non-substitutable basis for the economy.

43. Natural capital is not prominent in current conceptions of the tax system. As discussed in Chapter 3, New Zealand makes little use of environmental taxation. There is also little or no consideration of natural capital impacts in the development of new tax policy, and no reporting on the environmental impacts of current tax policy.

44. Yet taxation could serve as an important policy instrument to achieve our environmental objectives. Placing a price on polluting activities would help to ensure that polluters faced the full costs of their activities; there is also a choice to go even further and use environmental taxation to promote broader changes in the pattern of economic activity (alongside other policy instruments, such as spending and regulation). The additional revenue could also be used to support a transition to a more sustainable economy.

45. Given the non-substitutable nature of natural capital, the declining state of New Zealand's environment, and the increasing fiscal costs of mitigation and adaptation, the Group sees a case to broaden the base of the tax system and make greater use of environmental taxation. These issues are developed further in Chapter 9 on Environmental and ecological outcomes.

Overall judgements

46. This chapter has assessed the structure, fairness, and balance of the tax system through two lenses: the treatment of income from physical and financial capital; and the treatment of natural capital.

47. There are inconsistencies in the treatment of some forms of capital income. These inconsistencies raise a number of concerns for the Group:

- Fairness. The inconsistent treatment of capital income is unfair. This unfairness will only increase if the economy becomes more capital intensive through a greater use of technology replacing labour.

- Distributional impact. It is the wealthiest members of society who benefit the most from the inconsistent taxation of capital income. There is a risk that this regressive outcome erodes the social capital that sustains public acceptance of the tax system.

- Revenue sustainability. As the population ages, a greater proportion of the population will live off capital income in retirement. The economy is likely to become increasingly capital intensive and capital income, when compared to labour income, is increasing. A tax base that is sustainable over time – and that is fair in an intergenerational sense – will need to draw more upon capital income as well as labour income.

48. There are many considerations involved in the extension of the taxation of capital income. Chapter 6 on Capital and wealth will explore these considerations in greater depth, and begin to outline a number of options for broadening the tax base further.

49. There are also clearly opportunities to increase the use of environmental taxation[8]. The Group has prioritised considerations of environmental taxation during the course of its work. Chapter 9 on Environmental and ecological outcomes introduces a framework developed by the Group for deciding when to apply environmental taxes, and shows how this framework could be applied to different stocks of natural capital.

Notes

- [5]Subsequent chapters will explore further the taxation of savings and the treatment of taxable entities.

- [6]When a company pays a dividend then generally the income from the company will effectively be taxed at the personal level if the shareholder is a New Zealand resident.

- [7]Much capital expenditure, however, is deductible over time through depreciation.

- [8]Taxation in this context refers to economic instruments that can be potentially revenue raising for central or local government.

PART III - INTERIM CONCLUSIONS

6 Capital and wealth

1. The Group is considering the structure, fairness and balance of the tax system as it applies to wealth generally and capital income specifically. The Group has examined the merits of changing the tax system through extending the taxation of capital income to asset classes presently treated as giving rise to exempt capital gains. For the purposes of this chapter, capital is being used in its traditional sense of a factor in production rather than as a component of the living standards framework.

2. The Group is considering two main options for extending the taxation of capital income. These are taxing realised gains not already taxed from specific assets and taxing certain assets on a deemed return basis (a risk-free rate of return method, as an example). After consideration, the Group is not recommending either a general wealth tax or a land tax[9] for the reasons given at the end of this chapter.

3. Whether an extension of the taxation of capital income is assessed under either traditional tax principles or the living standards framework, its effectiveness will be dependent on its design. The Group has therefore sought to establish design principles or rules under which the taxes might be implemented, so that Government or affected taxpayers can consider all the consequences. Only once such an extension is designed can a meaningful comparison take place between the two options, or a combination of those options, and the status quo.

4. The Group has made good progress in the past six months in determining what income might be included from certain assets and how and when the income might be taxed. The Group is not currently in a position to make specific recommendations, but is intending doing so in the Final Report.

5. This chapter:

- Sets out the main policy considerations necessary for forming an overall judgement on extending the taxation of certain types of capital income. For the rest of this chapter it will be referred to as simply capital income.

- Records a summary of the Group's views on the design features for extending the tax on realised capital gains.

- Comments on the risk-free return method, wealth and land taxes.

6. Greater detail on extending the tax on realised capital gains is contained in Appendix B on Design Features for Extending the Taxation of Capital Gains.

Policy considerations

7. The 2017 OECD Economic Survey of New Zealand, as part of its analysis that New Zealand should adopt a broad-based capital gains tax, included a useful summary of the advantages and disadvantages (see Table 6.1 below).

8. The Group considers that this is a fair reflection of the key advantages and disadvantages expressed simply. However, in order to be able to recommend the implementation of such measures the Group will need to form the following overall judgement:

9. The following sections outline the main considerations for and against reform. This is to give a sense of the main issues at stake as the Group forms its views over the following months.

The long-term sustainability of the tax system

10. New Zealand, like other countries, faces growing fiscal pressures from an ageing population. Taxing capital income that is currently untaxed is likely to provide a significant and growing revenue base for the future. Such gains are the single largest source of income that other countries tax and that New Zealand largely does not.

| Advantages | Disadvantages |

|---|---|

| Increase progressivity of the tax system.1 | Inefficient lock-in due to incentive to hold on to assets to avoid paying capital gains tax. |

| Improve horizontal equity by taxing income whether it is earned on capital gains or otherwise. | Taxes accrue on nominal as well as real gains.2 |

| Improve efficiency through reducing tax-driven incentive to make investments in assets that provide capital gains rather than income, in particular housing. | In the absence of other tax changes, can discourage saving and investment through reducing post-tax returns, particularly if there are strict limits around relief for capital losses. |

| Reduce incentive to shelter income from tax by transforming ordinary income into capital gain. | Taxing gains on shares has potential for some double taxation of retained profits on which company tax has already been paid.3[10] |

- US and Australian evidence indicates that taxation of capital gains is highly progressive. This is likely to be the case for New Zealand too, as the distribution of wealth is more unequal than that of income: the top 20% of NZ households own almost 70% of net wealth and more than 75% of net wealth excluding owner-occupied dwellings (Statistics NZ, 2016).

- This is a feature of nominal tax system more broadly and is more important for taxation of interest-bearing assets. Because capital gains taxed on realisation benefit from deferral of tax payments, real after-tax gains increase over time and thus capital gains are less affected by taxation of nominal gains than are interest-bearing assets (Burman, 2009).

- Retained profits are not subject to full double taxation to the extent that there is a value placed on unused imputation credits that can be used for future dividends, as this value will be capitalised into the value of the company and thus increase capital gains (Burman and White, 2009)

Source: OECD (2006), Taxation of Capital Gains of Individuals: Policy Considerations and Approaches, OECD Tax Policy Studies No. 14; OECD (2011), OECD Economic Surveys New Zealand, OECD Publishing; Tax Working Group (2010), A Tax System for New Zealand's Future, Report of the Victoria University of Wellington Tax Working Group; Treasury and Inland Revenue (2009), “The Taxation of Capital Gains”, Background Paper for the Tax Working Group.

11. Taxing more capital income also taxes more income from land. Land has the advantage of being an immobile tax base, unlike financial capital and labour, which are increasingly mobile due to macro trends such as technology advances and globalisation. Broadening the tax base to include more income from land therefore helps to diversify and provide more flexibility in the system to respond to future changes.

12. Another important sustainability question, relates to the structure of the tax system. Despite the relatively small gap between our company tax rate and top personal tax rate, we already have integrity problems with people using company structures to lower their taxes. This is discussed further in Chapter 15. These pressures are only likely to grow if the company rate is lowered or the top personal rate is raised. Both of which are respectively high and low on average by international standards. A tax on realised gains on shares in effect forces retained earnings to be attributed to individual shareholders and in this way can, to some extent, reduce the scope for companies to be used to shelter personal income from higher rates of tax.

Fairness

13. A sense of fairness is central to maintaining public trust and confidence in the tax system. This is because a system that distributes the costs of taxation in a way that is perceived to be unfair will generate resentment and undermine social capital. Perceptions of unfairness will erode public acceptance of the prevailing levels of taxation, as well as the spirit of voluntary compliance that underpins efficient tax collection.

14. The tax system is inconsistent in its treatment of capital income because it does not generally tax gains from the disposal of capital assets. This inconsistent treatment compromises commonly understood notions of fairness in two ways:

- Horizontal equity. Individuals earning the same amount of income face different tax obligations, depending on whether they earn capital gains or other forms of income.

- Vertical equity. Higher income individuals and households tend to derive a greater proportion of their income from increases in values of capital assets than lower income individuals and households. The Group has received estimates from Treasury that, in New Zealand, 82% of assets potentially affected by an extension of the taxation of capital income are held by the top 20% of households by wealth. The current approach can be regressive if it results in lower tax obligations on those with greater economic capacity to pay.

15. The lack of a general tax on realised capital gains is likely to be one of the biggest reasons for horizontal inequities in the tax system. People with the same amount of income are being taxed at different rates depending on the source of the income.

16. Untaxed realised gains are estimated to be approximately 20% of accounting profits for SMEs.

17. Evidence from overseas and data on wealth in New Zealand suggests that capital gains are concentrated amongst those with high incomes and wealth. Including more capital gains in the tax system is likely to be the most feasible way to make the tax system more progressive without increasing tax rates.

18. Reform could therefore reduce inconsistency in the treatment of individuals, increase the progressivity of the tax system and enhance or maintain social capital.

Economic and efficiency impacts

19. The effects of an extension of the taxation of capital income from the perspective of economic efficiency are complex to assess due to a range of factors that can move in different directions. Regard will need to be had to the impacts any changes will have on encouraging and/or not inhibiting the flow of investments to underpin sustainable productivity growth. Specific impacts will ultimately depend on the detailed design and who actually bears the cost of the tax.

20. These impacts could include:

- A reduction in domestic private saving and investment in the affected assets. The ultimate impact on investment in those assets would depend on the degree non-residents and the government made up any shortfalls.